How to Set Up Shopify Taxes for Dropshipping

Even when you’re dropshipping, there are still taxes that you’re obligated to fulfill. Do you know what they are? If you don’t know yet, this article will break down what are the taxes that you need to pay when you dropship, how much you need to pay for each, and how you can pay. I know, I know, you hate taxes. All of us do, so it would be surprising if you don’t.

Fortunately, it’s not hard to meet your tax obligations as a dropshipping entrepreneur. I will show you what your tax obligations are when you do dropship with Aliexpress and how you can setup Shopify Taxes for Dropshipping so that taxes will be automatically collected for you when you make sales.

Exclusive Offer: Get Shopify 33 days for just $1 + The Online Store Starter Kit

Start your 3-day free trial, and enjoy your first month of Shopify for 1$ plus the premium package designed especially for new Shopify merchants!

Before we jump into the details, please keep in my that this article is pure advice from the Internet, not from well-trained accountants or lawyers, so that means you should always seek further advice from an expert, and not just rely on the advice that I’m going to be giving in this article. Now, let’s dive into the first question.

What taxes do you need to pay when it comes to dropshipping?

When it comes to dropshipping, there are two kinds of taxes that you’re obligated to pay:

- Income tax

- Sales tax

These two taxes are compulsory when you are a business owner. Let’s break down the easy one first: Income tax.

What is income tax?

Income tax is the money that you need to pay based on the profit that you store generates in a year. When you’re operating a store, you have revenue and net profit.

Net profit (Before taxes) = Revenue - Marketing costs - Inventory costs - Overhead costs.

Your income tax is calculated based on your net profit when do dropshipping before taxes. This is similar to when you have a job; you will have to pay income taxes based on your salaries. Your store’s net profit before taxes is basically the “salaries” based upon which you’ll have to pay tax.

And that means if your store does not generate any net profit, you won’t have to pay any income tax. Zero net profit does not mean your store has zero revenue. Looking back at the equation above, you can make revenues, but your net profit can still be zero because your costs are more than your revenues.

For the sake of this article, let’s assume that your dropshipping store does generate a net profit. So, where do you pay income taxes? The answer is the country where you live, and you pay income taxes to your local government. For instance, if you live in the US, you will pay your taxes to the US government. It does not matter where you sell your products, or where your customers are. That means if you sell your products to Europe, you still pay taxes to the US government. To help manage these financial details more accurately when using Shopify Plus plan, you might consider using the Shopify Plus Calculator.

Income tax is not really much of a headache to deal with as long as you know how it works. The trickier part is sales tax.

What is sales tax?

First off, while income tax is imposed on your net profit when do dropshipping, sales tax is imposed on the goods/services that you sell. Income tax is imposed by the federal government, so it’s applied nationwide. On the other hand, sales tax varies based on the state you live in.

Each state in America has its own sales tax rates, which is set up by the government of that state. For example, the sales tax rate in Louisiane is 9.98% (of the retail price of your products/services) while it’s only 1.69% in Alaska. There are some states where the sales tax rates are zero, such as Delaware, Oregon, New Hampshire, and Montana. These states are often considered as “tax havens” as you don’t have to pay taxes there.

Okay, now, this is where the sales tax gets tricky. In the past, you only had to pay sales tax when you have a physical presence in the states where you sell your products. For example, if you have an established dropshipping business based in NYC, you’re having a physical presence in NYC. That means if a customer buys a piece of clothing from your store, you’re required to collect and pay sales tax for that transaction. Let’s say that piece of clothing costs $20 at retail, and the sales tax rate in NYC is 5%, which means you’ll need to collect the total of ($20 + $20*%5) = $21 for that order.

On the other hand, if the customer is from New Jersey and buys that piece of clothing online, you don’t have to collect and pay sales tax for that order because you don’t have a physical presence in New Jersey. So, you only need to collect $20 for the order because there’s no sales tax.

However, this old law is peeled, unfortunately, and replaced by a new rule called South Dakota vs. Wayfair passed on June 21. This new law says large vendors need to collect and pay sales tax, whether they have a physical presence in a state or not.

This leads to the question: does it mean that you have to collect sales tax for every order whether or not you have a physical presence in that state where the order is made. Fortunately, the answer is no.

You’re required to collect and pay sales tax under the new law if you meet the following requirements.

- A state needs to pass a new law that replaces the old law (most states up to this point have not passed a new law yet)

- You need to fall into the group of large vendors. The current baseline for being a large vendor in a state is generating $100,000+ in sales or 200+ transactions over a year.

This means that even for established big stores, they only need to collect and pay sales taxes where their yearly sales numbers are more than $100,000. So, if you’re a new business, you don’t have to worry about this sale tax until you grow big enough and start making huge revenue.

For now, you only need to pay for income tax and sales tax for orders made in the states where you have a physical presence (mostly the state where you live). You don’t have to worry about setting up taxes in your pricing either, because Shopify has made it a piece of cake.

Free 1:1 Shopify consultation & 30-day all-app trial FREE

- Shopify Plus Strategy and Consultation

- Personalized E-commerce Solutions

- Conversion Rate Boosting Techniques

- Inventory Management Hacks

How to set up dropshipping sales tax in Shopify?

If you’re running a Shopify Store, you can set things up so that Shopify automatically collects sales tax on each order that you make. You can follow the below steps to set this up.

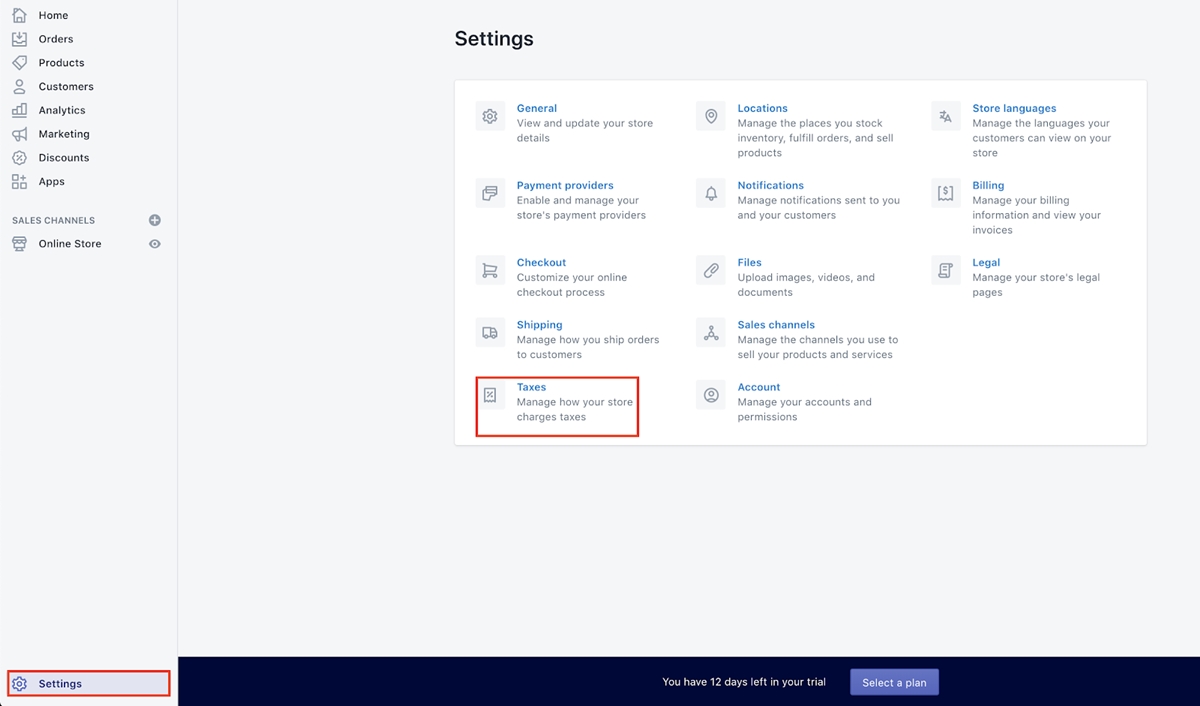

Step 1: In your Shopify dashboard, go to Settings, then go to Taxes.

Step 2: Click the Edit box in the United States section.

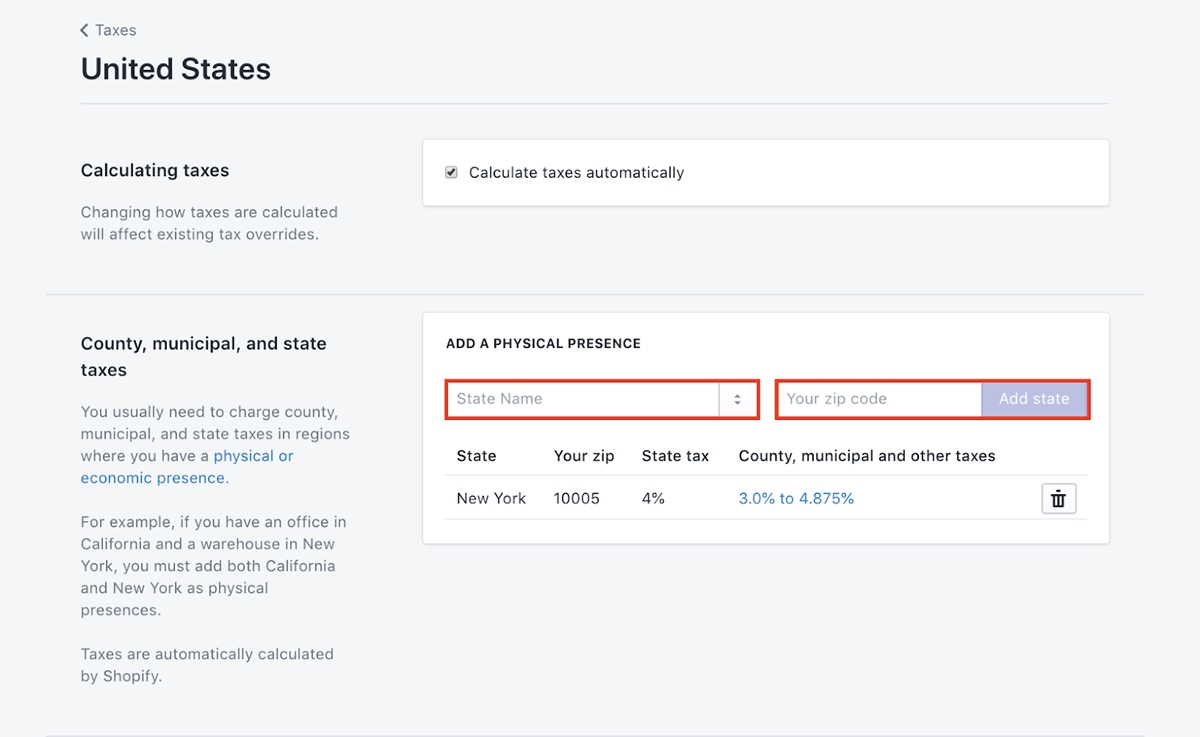

Step 3: Add the state where you have a physical presence. I have added NYC, so New York shows up under the boxes. Then click Save.

If you have a physical presence in different states, Shopify will automatically collect the right amount of sales tax on an order based on each state. Orders coming from states where you don’t have a physical presence will face no sale tax.

Final Words

So, here are the key takeaways from this article for you.

- You’re obligated to pay income tax on the net profit that your store generates. This is paid to your government where you’re based, and you will need to pay this tax annually.

- Online merchants are required to collect and pay sales tax in any state where they have a physical presence.

I hope this article has relieved the headaches that taxes have caused you and help you to set up your Shopify Taxes for Dropshipping easier.

If you have any further questions, please leave a comment below. :-)

Related Posts:

New Posts