Return on Sales Formula & Other Thing You’ll Need to Know!

Every business has specific goals and one of the main purposes is profit generating. Running a business needs a lot of money, so it is important for a business to earn a profit to invest more in the business to make it a constant process.

How can you apprehend whether the revenue is converted into real profit or not and how much proportion of the revenue your actual profit is after subtracting all the spending? That’s the reason why the Return on Sales is devised.

In the article Return on Sales 101: Formula and Other Thing You’ll Need to Know, we’ll bring to you useful knowledge of this measure so that you can easily apply it for your business.

Related posts

What is return on sales (ROS)?

Return on sales (ROS) is a measure used to evaluate the operational effectiveness of an organization. This ratio gives insight into how much profit is being generated per dollar of sales. An accelerating ROS shows that an organization is developing more successfully, while a lowering ROS could predict forthcoming financial problems. ROS is very related to the operating profit margin of a company.

For instance, an organization that produces $100,000 in sales and needs $90,000 in total costs to produce its revenue is less effective than an organization that produces $50,000 in sales but only needs $30,000 in total costs.

ROS is larger if a firm’s management efficiently reduces costs while raising revenue. Using the same example, the firm with $50,000 in sales and $30,000 in costs owns an operating profit of $20,000 and a ROS of 40%. If the firm’s management team wants to boost effectiveness, it can concentrate on escalating sales while incrementally raising expenses, or it can concentrate on reducing expenses while maintaining or escalating revenue.

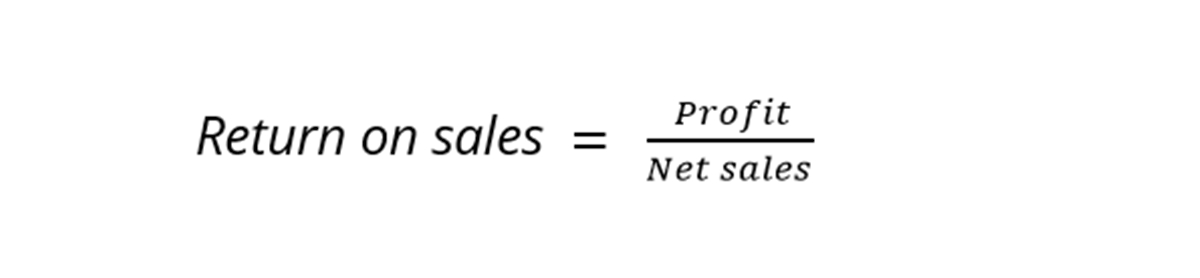

What is the formula of Return on sales?

Return on sales is gauged by dividing your company’s operating profit by your net income from sales. For example, given that your business generated $500,000 in sales and $400,000 in expenses this previous quarter.

If you would like to measure your return on sales, then you would initially define your profit by eliminating your figure from your revenue. In this example, you would gain $100,000 in profit. You would divide that profit number by your total revenue of $500,000 - resulting in a ROS of 20%.

ROS is usually reported as a percentage. Therefore, in most situations, you would multiply that final figure by 100 and use that to report your ROS - and it would be 20%.

That percentage shows the number of cents you get in profit for every dollar you gain in sales. In this case, your ROS would be 20 cents per dollar.

To measure return on sales, eliminate your spending from your revenue and divide that number by your revenue.

Return on Sales = (Revenue - Expenses) / Revenue

Why should you mind ROS of your business?

Return on sales in a financial ratio that measures how effectively a firm is producing profits from its top-line revenue. It gauges the efficiency of an organization by analyzing the percentage of total revenue that is turned into operating profits.

The ratio indicates how efficiently a firm is creating its main products and services and how its management drives the business. Hence, ROS is utilized as a gauge of both effectiveness and profitability.

Investors, creditors, and other debt holders depend on this performance ratio as it precisely indicates the percentage of operating cash a firm makes on its revenue and brings insight into potential dividends, reinvestment, and the capability of the firm to repay debt.

ROS is to compare present period calculations with calculations from past periods. This enables an organization to do trend analysis and compare internal effectiveness performance over time. It is also helpful to compare the ROS percentage of one firm with that of another competing firm, regardless of scale.

This comparison helps to easily assess the performance of a small business in relation to a Fortune 500 company. Nevertheless, we should only use ROS to compare organizations within one industry because they differ adversely across industries. A grocery chain, for instance, has decreasing margin and so a decreasing ROS compared to a technology company.

Return on sales and other margins

ROS vs Profit margin

Two terms “return on sales” and “profit margin” can be replaceable for each other, but those meanings are only partially exact. There are multiple types of profit margins - only one of which is similar to return on sales.

Net profit margin

Net profit margin is a ratio that can be used to compare net profits and sales. To measure this figure, divide a firm’s net profit after taxes and total net value of sales. If your business earned profits of $150,000 after taxes and net sales of $100,000, your net profit margin would be 150%.

Net profit margin is a gauge that allows companies to compare their performance in many different periods of time. Companies usually use this number when they look over their previous performance.

Gross profit margin

To measure a company’s gross profit margin, eliminate the cost of all products sold from the value of the sales and then divide that number by the value of sale. If you earned sales of $50,000 and the cost of products sold was $20,000, you would deduct $20,000 from $50,000 and divide the difference of $30,000 by the sales of $50,000 - resulting in a gross profit margin of 60%.

Gross profit margin is typically used as a standard for comparing a variety of companies. It’s a great way to measure how effectively a certain firm can produce profits relative to its competitors.

Operating profit margin

Operating profit margin is a different term for return on sales. You can use the ROS equation to calculate this figure.

ROS vs Operating profit margin

Return on sales and operating profit margin are interchangeable to indicate the same financial ratio. The key difference between each usage is how their respective formulas are derived.

In the standard formula for operating margin, you’ll divide operating income by net sales. The return on sales is the same. Only the numerator is typically written as earnings before interest and taxes (EBIT). The denominator is net sales.

Further readings

- How To Calculate Variable Cost?

- How To Calculate Revenue?

- How to Calculate Cost of Goods Sold? COGS Formula

Conclusion

Through this brief article, we expect that you apprehend more about Return on Sales and its Formula. With ROS, you can find it easy to measure your business’s efficiency and compare your current performance with performance in previous time periods, consequently finding ways to enhance it.

If you have questions or concerns about Return on Sales, leave them in the comment box. We’ll answer you immediately.

Thank you!

New Posts

How To Set Up Google Analytics 4 For Your BigCommerce Store