ACH vs Wire Transfer: Which Method Should You Use To Transfer Money?

If you did at least research about transferring money from one financial institution to another, you must have heard about ACH and Wire, which are two giants in the market. They are used for large ticket items such as manufacturing equipment, inventory, or even payroll, which cannot be applied for a credit card or even card like smaller items and office supplies.

When digging into the features and detailed services of those two solutions, we find that each platform has its advantages and drawbacks. Being suitable with ACH doesn’t mean you are also suitable for Wire. They differ in terms of fees, transaction speeds, security, and international capabilities. If you look at international payments, let’s come to Wire. If you are looking for cheaper payments but more secure, what’s about using ACH?

Knowing your demand for identifying which payment matches your business, we have this ACH vs Wire Transfer: Which Method Should You Use To Transfer Money? which will make an ultimate comparison between the two and discuss how a business can pay money out to vendors or suppliers.

Let’s dive in!

What is an ACH transfer?

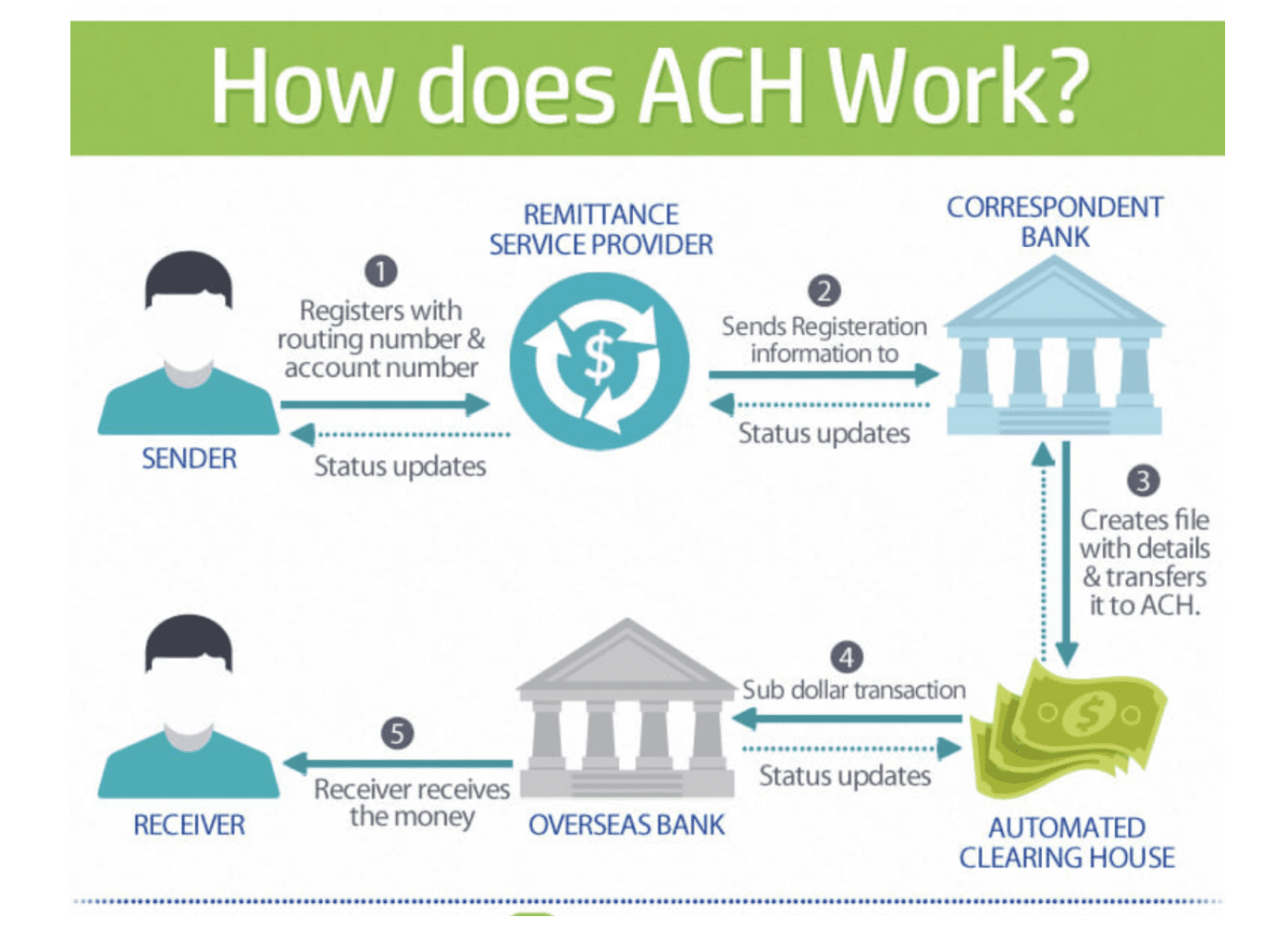

How do ACH transfers work?

After understanding how banks transfer money from one account to another, it must be easy to know what ACH transfer is as well as its mechanism.

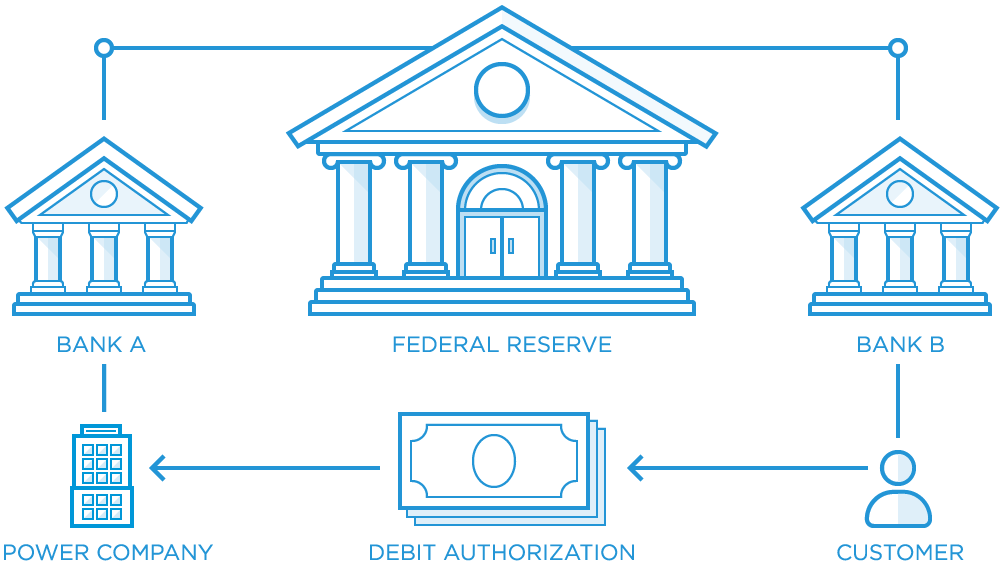

ACH transfer, which is also known as direct deposit, stands for Automated Clearing House. It is the name of a network that is used by the method to send funds from one bank to another. Easily put, the ACH process is made when a request is sent from the bank account of the person who pays. Then, the money will be sent via the ACH network to a recipient’s bank.

The Automated Clearing House network is a network of financial institutions that includes bank and credit unions. Those elements are likely to batch transactions between them using a specific type of code. The code is built up and guided by an organization named Nacha which used to be NACHA standing for the National Automated Clearing House Association. This is a US-based network and not available for payees who are located outside the United States. To be more specific:

-

When domestic money is moved in the US: The code is likely to be transferred through a computerized network for which the Federal Reserve is the Central bank.

-

When money is transferred internationally outside the US, the code tends to be transmitted via the SWIFT network to another bank beyond the US accepting ACH codes. SWIFT network is a computer network often used for international money transfers.

ACH payments are said to have the roles of both direct deposit and direct pay via ACH. In general, though the cost of ACH transactions is much lower than its rival, Wire transfers, its service is not worse since it can take longer to stay in the payee’s bank account, which is likely to delay when you make sure that the payment was sent. Normally, ACH transfers can be done either in groups or batches.

Types of ACH transfers

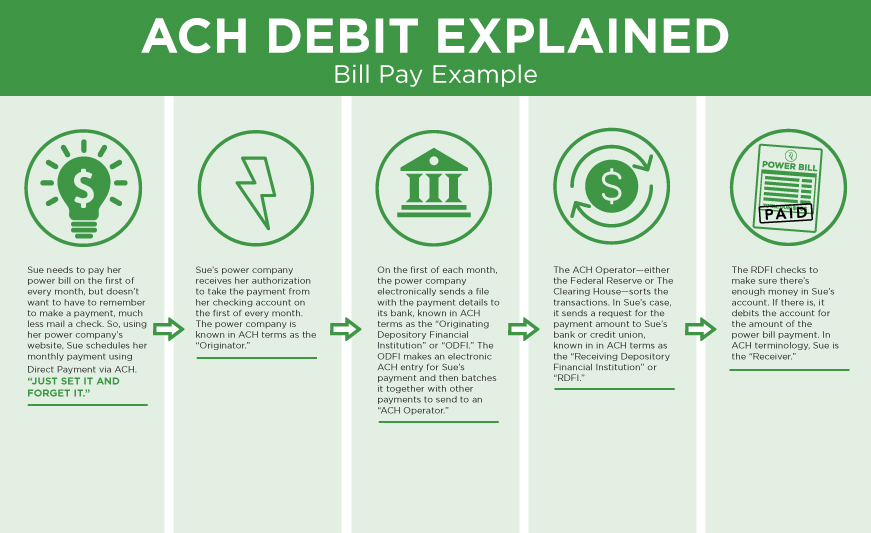

There are two secondary types of ACH payments, which are Credit ACH payments and Debit ACH payments

- Credit ACH payments: They are one-time payments that allow the senders of the money to authorize each payment before the money is sent out. To receive money, the receiver of an ACH credit payment initially provides the sender with his bank data including bank account number and bank routing number. The bank data will then be sent by the sender with an attempt to pay a particular amount. This data is often attached with instructions to its bank.

After that, the information about payment is batched and continually sent to the Central bank for settling based on a daily schedule. When you have let your transfer be settled, the money will be displayed in the account of the receiver. Remember to make sure the type of payment is appropriate to payroll or occasional bill payments in which you can come to control the place to send money to as well as a certain amount of money to pay.

- Debit ACH payments: They are recurring payments that allow money from many different accounts to be taken from an account to a set schedule. Being suitable for recurring bills like utility payments, Debit ACH payments enable the payee to send the bank information to the entity in which payment is due. A payee can provide information such as account number, routing number, and payment authorization. For those who don’t know, one a fixed day of each month, the receiver of the payment will send a payment request to its bank.

Then, the information is batched and given via the Central bank to the bank of the payor. After checking for previous authorization and sufficient funds in the account, the bank of the payor will then tell the Central bank to release the money if there are enough funds.

What is Global ACH?

Global ACH is a version of US ACH which is used to make cross-border payments via international transfers. Surprisingly, the Global ACH does not have standards like other US ACH systems provided by Nacha for network financial institutions in the United States. On the other hand, international ACH impacts the existing ACH capabilities of a country’s banks outside that country to carry out cross-border payments effectively and affordably.

Read more:

- What Is An Electronic Check?

- PayPal Personal vs PayPal Business

- Top 15+ Best PayPal Alternatives

- Stripe Payment Review

What is a Wire transfer?

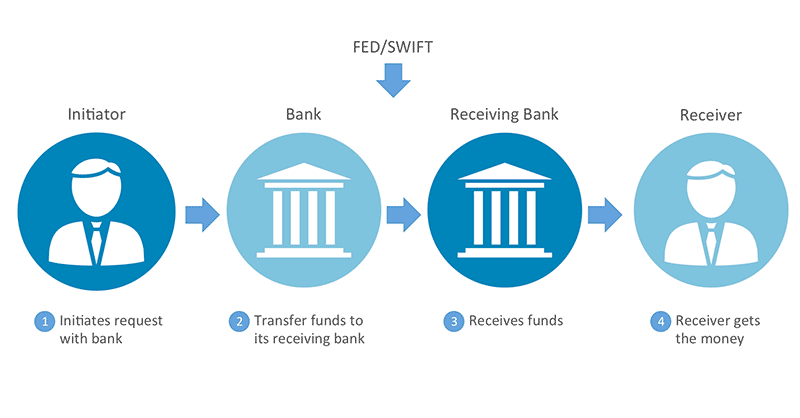

How does a Wire transfer work?

Wire transfer is a traditional solution in which banks transfer money using the method mentioned earlier. It is an electronic interbank payment used to transfer money directly from one entity’s bank account to another one. Here are some notes about Wire transfers:

- Wire transfers are specific and one-time transfers.

- Its instructions are the bank account number and ABA bank routing number, which can be used for the people receiving the money.

- When wire payments are used, the money will be immediately available in 1 day upon coming to the payee’s bank account.

- The process of recalling the wrong transactions turns challenging when the funds are wired with immediacy.

- If you send money with high volumes via wire transfer, be aware of the transaction fees since it may be higher than you expect.

- If you are constantly changing international payments made by parties in the transaction to bank accounts located in different areas of the world, nothing is more suitable than wire transfers.

- Domestic US wire transfer messages are transmitted via the Fedwire network or the CHIPS network instead of telegraph lines like the old days.

- Cross-border wire transfer messages are often transmitted over the SWIFT network.

- A bank will send the money without batching.

- How sending banks and receiving banks transfer the money depends on the business relationship between them. The two most common methods are changing their account ledgers and using a central bank.

- If you are making international wire transfers, either changing your account ledgers or using a central bank is suitable.

- If you are making a domestic US wire transfer, the Federal Reserve will act as the central bank. Once the sending bank, the receiving bank, and the central bank are all open for business, the wire transfers are possibly ordered.

Guide to make a wire transfer

To make a wire transfer, here are what you should note:

- Get the account data and routing number of the receivers.

- Make contact with your bank and send a request to have them make the transfer. Take a note that you can only show the transfer date, not the computer network the bank uses to send the transfer order.

Unlike ACH transfers scheduled for recurring payments, there will be no monetary cap on a wire transfer; Wire transfers are one-time transfers, which means they are irreversible when one is made. As a result, wire transfer is not the right choice for regular payments, such as payroll or utility bills. On the other hand, only consider it when you want to pay for one-time equipment purchases or large inventory.

Should high-risk merchants use wire transfers?

Well, there are no reasons proving that high-risk merchants should not use wire transfer in sending or receiving payments. However, it’s important to note that a wire transfer fee is expensive and not affordable in some cases. If merchant’s purchases are for smaller amounts, they are likely not to earn much from it.

Also, be careful since you can easily mistake bank-to-bank wire transfer with sending money through Western Union or other person-to-person transfer services like Venmo. These money transfer services are not wire transfers but using a different business model and messaging system.

How banks transfer money between accounts?

Now you must have understood thoroughly about ACH and Wire, right? However, before coming to the ultimate comparison between two giants, it is necessary to know how banks transfer money between two accounts. We will give you the reasons why they need to do it and five methods to transfer money. Nonetheless, keep in mind that those methods are all in use since the 1600s, and some of them are not suitable for current situations.

Therefore, in the past some decades, the automation feature has been added to the process, enabling the information to be transmitted to and from privately maintained and secure computer networks. So, let’s come to the first method!

Transfering between two accounts within the same bank

The first method and the simplest form of transferring money are passing money on between two bank accounts located at the same bank.

Let’s look at the following example. A and B bank at the same bank. Then, A has the intention to transfer $100 to B. After that, the bank’s only task is accessing the two accounts and displaying that $100 has been transferred from A to B.

In case A and B’s bank accounts are not located in the same bank. Then let’s move to the second method to see two ways to transfer the money.

Transfering between two accounts from different banks

The first method refers to two banks that have bank accounts with each other. However, what’s about transferring between two accounts from different banks? The example will become more complex.

A is a person who lives in New York and banks with Super Bank. This bank is located in the same state. B is a person who lives in California and banks with Mega Bank also located in California. Then, A has the intention to give $100 to B as a personal loan. Despite being not the same bank, Super Bank and Mega Bank have bank accounts with each other. Therefore, Super Bank will make ledger access to take $100 from A’s bank account and add it to Mega Bank’s account which is located in Super Bank. Now Mega Bank has an addition of $100 in its system.

Next, when in Mega Bank in New York, Mega Bank will also make an account book entry and give $100 to B. So, Mega Bank then does not have an extra $100 anymore. This transferring process is made without any physical movement. A is allowed to pay $100 to B, and there is no box of money being transferred from New York City to California.

The practical effect is that Joe has paid Steve $10 even though no bag of money moved from Los Angeles to New York.

Transferring via a central bank

In case Super Bank and Mega Bank do not have bank accounts with each other, it’s still fine since there will be a third party, which is also known as Central Bank. The central bank will be the one having bank accounts with both named banks.

Then, the process of moving money will be like:

- A wants to pay $100 to B as a loan

- Super Bank will tell Central Bank to transfer $100 from Super Bank’s account at Central Bank to Bank’s account at Central Bank

- A notification will be sent to Mega Bank, saying that there is an addition of $100 in its account at Central Bank

- Mega Bank will pay $100 to B

Like the second method, there is no money bag physically moved to and from any banks, but money is still paid to B only via a ledger entry that was made at the Central Bank.

Batching for Efficiency

We have taken an example of $100 moved from A to B. But what if A just wants to pay $5 or $10 to B. Let’s imagine, there will be millions of times in a day when many small amounts of money are moved back and forth between people who bank at Super Bank and Mega Bank, especially in modern eCommerce. Central Bank is not likely to move such a tiny amount of money the banks’ accounts back and forth all day long, every time a transfer order is made. On the other hand, banks will hold all the transfer orders until the end of the day.

Then, they will total up the transfer and handle only one transfer on the net change. This process which is also known as Batching has long been used as a traditional method. Once the batching process occurs at the end of each business day as it always does, there will be no opportunities when this cannot happen several times a day or even once every several days.

The Central Bank

Central Bank does exist, and each country in the world all has its central bank. The style, rules, and specific version of each country’s central bank are all different. For example, the US’s Central bank is the Federal Reserve; when most US domestic money is moved between banks often go through the Federal Reserve.

When it comes to international transfer, banks need to have direct accounts with each other. Another way is finding a bank and making it work as a central bank.

Differences between ACH Transfer and Wire Transfer?

Security

In terms of security within ACH and wire payments, there are many obvious issues. For example, money transfer messages can be hijacked during the process, or fraudulent transfer messages can be initiated by criminals.

Wire transfers claim to be secure if the transactions are legit and not coming from fraud. However, wires are used in scams most of the time.

Usually, fraudsters who try to start any fraud will use a simple trick of posting phishing schemes that encourage users to click on an email link to a fraudulent website designed to look like authentic ones. They can also send an email that looks like an escrow company’s email to a real estate agent asking for funds to be moved to the scammer’s bank account instead of the seller’s bank account in a real estate transaction.

In 2016, The CFPB issued rules of the US government for remittance offered more than $15 to protect the US’s consumers. They are those who make cross-border electronic payments to other countries outside the US by using wire transfer, ACH transactions, or transactions made through retail “money transmitters.”

The CFPB rules include:

- Upfront disclosures about all fees, taxes, and the exchange rate, including those charged by agents abroad and intermediaries.

- Upfront disclosures about the time will be available at the destination.

- Upfront disclosures about receiving a receipt or detailed amounts equivalent to a receipt in the disclosure and the right to cancel the transfer within a short time window of at least up to 30 minutes

- Upfront disclosures about what to do in case of an error

- Upfront disclosures about guide to submitting complaints

Additionally, CFPB rules also discuss other protections, such as canceling on time to get money back or what payment transmitting companies should do. They need to investigate errors when a consumer reports a problem to them and give consumers a refund or resend the transfer again free if the money did not arrive.

In terms of ACH transfers, its electronic transfers are securely maintained as ones between many different banks. However, it is still possible for users to suffer from having a fraudulent vendor invoice or supplier in the payables system. Luckily, ACH provides an automated payables and global mass payments software app and extensive fraud prevention controls to avoid this risk.

Cost & Fees

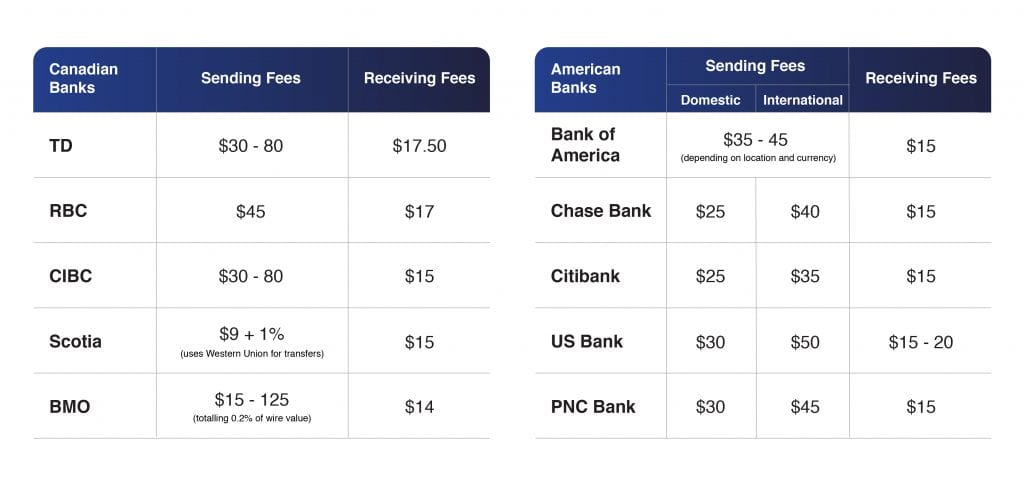

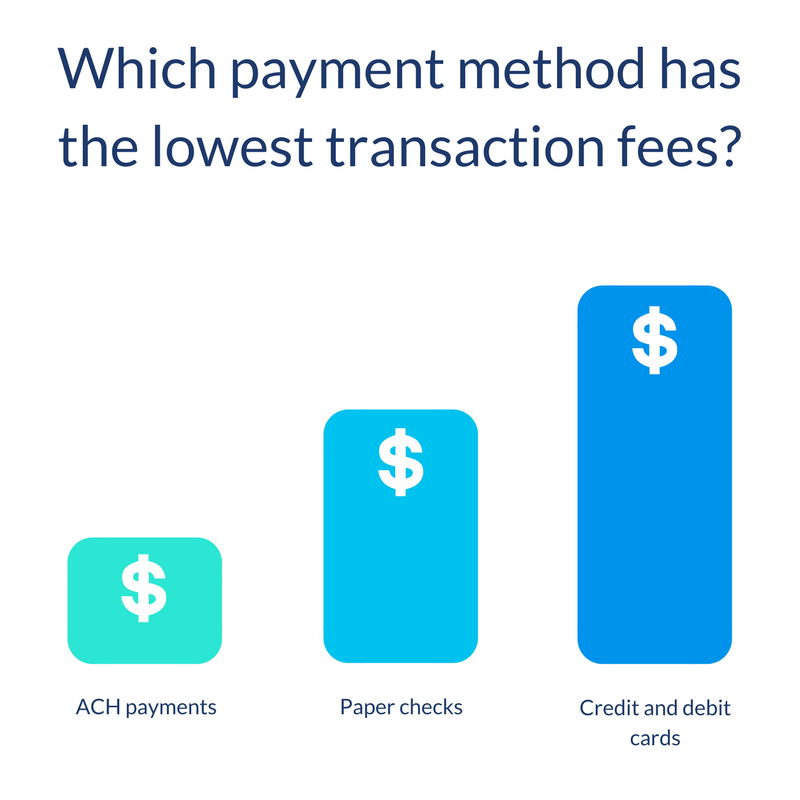

All in all, Wire transfers cost much more than ACH transfers in most of the case. Wire transfer fees for domestic transactions are from $20 up to $100 for users to send, receive, or act as an intermediary in a wire transfer transaction. To make a domestic US wire, it takes between $10-$35 to send a wire. Sometimes, it’s free to receive one.

Additionally, note that international wire transfers are even more expensive. Specific wire transfer fees and extra costs verify based on each bank. They usually include service fees, investigating charging, and wire resubmission costs for those who are not protected by CFPB rules.

Being expensive, wire transfer offers services that are worth spending money on. First and foremost, you don’t need to care about any savings from efficiency since these wire transfers are made individually and immediately without batching. Secondly, ACH is well known for being affordable and there are many other networks costing more than the ACH network. For example, the Fedwire, CHIPS, and especially the SWIFT network. Moreover, since the process within wire transfers is not automated but involves human efforts. For instance, they need bank staff who will initiate and confirm the transfer.

Therefore, it is easy to understand why the cost of wire transactions is that high.

In regards to ACH payments, it is much cheaper in comparison to wire transfer fees and other networks. To be more specific, besides ACH payments, payment processors that contain IMS (Intuit Merchant Services) also process debit cards and credit cards. Then, IMS needs to take money from ACH transaction fees for payments. What’s more, when it comes to rejected ACH transactions, IMS charges an ACH Reject Fee (also known as Electronic Bank Reject Fee) of $25 for each. A large number of bank customers assume that getting ACH payments is free even though their bank can charge a fee for it.

As you know, in terms of US transfers, the ACH code is moved by the ACH network. Being owned by many different large banks, it’s easy to understand why they all charge a fee for transmitting messages over that network. The fee ranges from $0.20-$1.50 per transaction or 0.5%-1.5% of the total transaction cost. In some cases, the fee is so small that US banks do not need to charge their customers for making an ACH transfer.

When it comes to international transfers which seem to cost more, the ACH code is usually transmitted over the SWIFT computer network. So, though ACH is well known for its cheap price, this fee is decided by the SWIFT network instead. And yes, it charges more. In that case, it is vital to get advice from your payment processor or your bank, who will give you information to help you understand the charges involved and have a better decision.

Transaction speed

Wire transfers have a quick transaction speed when every stage was made within 24 hours. Once a customer submits a bank wire transfer order from their US financial institution’s same business day deadline, all that money will be transferred by the bank and received in the payee’s bank account in the United States.

All those steps are taken on the same day and solved in 24 hours. The process of sending wire transfers by the originating bank is made a bit later within the next business day. What’s more, international wire transfers may take longer to complete in comparison with domestic wires.

On the other hand, it takes ACH payments transactions up to three days to receive. This speed tends to be longer than that of wire transfers.

However, in the short future, ACH payments totally have a chance to become much more competitive. Thanks to faster funds availability provided by Nacha in September 2019, ACH transactions and credits are possibly received in the same day or the next day. In March 2021, Nacha is going to add two hours via a third processing time window to the business day submission deadline for ACH debits, which helps fasten the ACH transaction speed.

According to the adjustment of Nacha on September 20, 2019, the Nacha rule establishes additional funds availability standards for ACH credits. Here are some details about it:

- Funds from Same Day ACH credits processed in the existing in which the first processing window will be made possible to approach by 1:30 p.m in the RDFI’s local time

- Funds from non-Same Day ACH credits will be available by 9:00 a.m.

- In case you don’t know, RDFI stands for Receiving Depository Financial Institution. Easily put, it is the receiving bank for the transfer of funds.

When it comes to the rule change in March 2021, it is likely to build a third Same Day ACH processing window that expands Same Day ACH availability by 2 hours. Here are some details about it:

- The latest time when an ODFI can submit files of Same Day ACH transactions to an ACH Operator is 2:45 p.m. ET (11:45 a.m. PT).

- The new window will enable Same Day ACH files to be submitted until 4:45 p.m. ET (1:45 p.m. PT), which gives an opportunity for all ODFIs and their customers to get access easily.

- By minimizing impacts on financial institutions’ end-of-day operations and the re-opening of the next banking day, this new processing window’s timing is about to adjust the desire to expand access to Same Day ACH through extended hours.

Also, ODFI stands for the Originating Depository Financial Institution (also known as an originating bank), which will is the sending bank for the ACH transfers. What’s more, in August 2019, Nacha released a statement that pushed the Federal Reserve Board’s plan to move to an ACH real-time payment and settlement system.

Easily to see, at the current time, Wire transfers take the lead when it comes to transaction speed but ACH is likely to improve its service to win the round.

Geographical limitations

When it comes to geographical limitations, the ACH solution had the cross-order payment limitation, while Wire transfer does not provide.

On the other hand, Wire transfer is able to send funds to a bank outside the United States, whereas Domestic ACH cannot. That means it is limited within the US even though international payments can be made via other banks to the bank network in a tool that we have mentioned earlier, Global ACH.

Therefore, it should be a tie in this round when each platform has its own limitations. At the same time, Wire transfer and global ACH all make way for cross-border payments.

B2B payments

In terms of B2B (Business to Business) payments, Wire transfers are such a good solution for those businesses which are high-dollar or those using business payments such as commercial real estate transactions or M&A transaction payments. Luckily, Wire fees are not added when considering the transaction amount and quick funds availability in those situations.

In regards to ACH, businesses that apply B2B payments tend to depend on an ACH API or a bank API to make these payments. What’s more, payables automation software is considered highly effective for batch processing vendors, suppliers, or other payments. A small fee ACH seems to attract more volume justifies than wire transfer payments. It may be because the fact that businesses make so many bill payments per day.

To sum up, ACH is the winner in this round since it had ACH transactions for normal business to business payments.

Personal payments

This is B2B payments. So, what’s about personal payments?

Wire transfers are suitable for large personal residential real estate purchases, which also include down payments. That’s why many users tend to use Wire transfers for global cross-border payments for their individual purposes either directly or indirectly.

In this case, customers will have a chance to pay for an international money transfer, which is taken via the Western Union money transfer services system going along with a Wire transfer using their bank account. Western Union names this paying method as a wire transfer payment option.

Meanwhile, banks enable each user to use ACH for bill payments by using their online bank accounts.

So, in terms of individual payments, Wire transfers take the lead when it is especially suitable for large one-time transactions.

Who is ACH transfer and Wire transfer for?

As I have mentioned, ACH and Wire differ from each other in terms of many criteria. In general, each transfer has its own uses and drawbacks. Let’s find out whether you are suitable for ACH transfer or Wire transfer.

Who is ACH transfer for?

ACH transfer should be considered in the following cases:

- If you want to send and receive small payments that can be planned and paid out automatically.

- If you are expecting an affordable solution. ACH contains a huge part which is an automated process asking for no human intervention.

- If you want to have a transfer helping you make a business to business (B2B) payments. ACH payments enable batch processing to result in efficiency and make the payment amounts much smaller.

- If you are looking for a payment letting you make personal online bill payments in the United States without spending too much money on fees. Many banks and other financial institutions offer free bill pay via ACH.

Who is Wire transfer for?

Wire transfer should be taken into account in the following cases:

- If you have larger and one-time transfers, ACH is not suitable since it may harm your time-sensitive transfer. It is within those domestic transaction amounts, the higher wire transfer fee is quite small and you need 24-hour funds available if you meet the time window for same-day submission.

- If you want to have a transfer involving humans to send and receive the payment.

- If you are expecting a solution with large B2B transaction payments such as commercial real estate and M&A transaction payments.

- If you want to make large personal payments which include real estate down payments and the remaining payment due on the real estate sales price plus closing costs.

- If you want to make one-time personal payments justifying paying the wire fee.

In fact, it is impossible for a business to grow like wildflowers if it only relies on paying with or receiving ACH payments or Wire transfer. For example, when making international payments, it is necessary to use both Global ACH and Wire transfer.

If you are maintaining a company that doing business only with other businesses, you can totally choose one of two solutions to use.

But if you don’t, it will be hard for customers to choose from paying with ACH or paying with Wire transfer and you may lose opportunities from it. It is because each of those payment options can contribute to your normal payment card processing options.

It will be easy to understand to merely add ACH and wire transfer as a payment option.

Related posts:

- What are Recurring payments?

- Best Payment Gateways for Shopify Dropshipping

- Venmo For Business Review

- Square vs Paypal: An Honest Comparision

Conclusion

In conclusion, each platform has its own pros and cons.

Wire transfers’ plus point is its moving funds quickly between accounts in either different bank cases or other financial institutions cases. What’s more, cross-border payments with continually changing rules are not an obstacle for users any more thanks to Wire transfer. If you are focusing on reliability and speed or using large one-time transactions, Wire transfers are ideal for you.

In terms of ACH transfer, this method tends to be a dominant payment method in the future, especially for mass payments. It is due to its lower cost and almost less risk, which makes it attract more and more users. In case you are making transactions where the amount is smaller, or the frequency is more regular, let’s take into account ACH transfers. Additionally, thanks to the Federal Reserve’s plan under consideration to move to real-time ACH payments and settlements, ACH payment is even more impressive.

Hopefully, this post helps give you an ultimate review of ACH payments and Wire transfers, which includes a complete comparison of all fronts. If you have any questions, don’t hesitate to leave us a comment in the section below. Share the article if you find it interesting and visit our site for more.

New Posts

How To Set Up Google Analytics 4 For Your BigCommerce Store